Bridging AI and Crypto: Tackling Data Ownership, Valuation Mismatches, and Infrastructure Gaps

Crypto tech play a complementary role for AI. Leveraging decentralization, privacy protection, and resource integration to address shortcomings in data ownership, long-tail resource integration, etc.

Takeaways

Crypto’s Role for AI:Crypto is not designed to replace traditional AI. Instead, by leveraging decentralization, privacy protection, and resource integration mechanisms, it addresses structural shortcomings in data ownership, long-tail resource integration, and transparent governance. In doing so, crypto provides AI with novel computational power and security guarantees.

Challenges in the Decentralized Compute Market:Today’s market faces low data transmission efficiency, mismatches between hardware performance and demand, and imperfect incentive mechanisms.

State of the AI Agent Ecosystem:AI Agent projects have experienced issues such as a mismatch between technology and valuation, supply–demand imbalances, and excessive speculation. There is an urgent need to reconstruct economic models and infrastructure through open-source models and on-chain verification.

Vertical Domain Breakthroughs:Fields like finance and gaming—where on-chain data is abundant and privacy requirements are clear—offer a smoother path for deploying specialized AI models.

Token Economic Mechanisms:To avoid speculative bubbles, token incentives must be tightly linked to actual data contributions and computing stake. Protocol revenues should be reinvested through token buybacks to form a self-sustaining value loop.

ICP’s Contribution:Leveraging a full-stack decentralized architecture, a distributed compute market, and data–model interaction protocols, ICP establishes a trustworthy foundation for the Crypto+AI ecosystem and demonstrates significant application potential.

Introduction

Crypto and AI continue to collide, generating new sparks—particularly within the AI Agent domain. Once hailed for revolutionizing automated trading and DeFi strategies, AI Agents have seen dramatic market changes. According to CoinGecko data as of February 2025, the AI Agent sector’s market cap dropped from a peak of $19 billion to $6.23 billion, with over 83% of project tokens falling more than 90% from their highs. This article draws on project practices, technical trends, and industry perspectives from 2024 to 2025 to explore:

What unique value does crypto provide to AI?

How does AI empower the crypto ecosystem?

Our purpose is to investigate existing technical, economic, and user-demand difficulties, as well as prospective breakthrough directions.

Unique Value Crypto Provides to AI

Decentralized Compute Market

Platforms such as Akash, Render, and io.net are working to pool idle GPUs worldwide to reduce costs for AI model training and inference. This approach can theoretically break the monopoly of centralized cloud services. However, practical challenges remain:

High Data Transmission Requirements:

Distributed training demands extremely high data transmission speeds. While centralized data centers benefit from technologies like NVLink and InfiniBand, on-chain networks suffer from bandwidth and latency limitations—often operating at only about one-tenth the efficiency of centralized systems.Hardware Mismatch:

Enterprise-grade AI applications require high-performance devices (e.g., H100 GPUs). In contrast, many decentralized projects rely on consumer-grade GPUs (such as the RTX 4090), which are only suitable for low-end inference tasks.Incentive Mechanism Shortfalls:

Existing token incentives fail to adequately align compute supply and demand, ensure high-quality data annotation, or standardize hardware performance, making sustainable economic models difficult to achieve.

Data Privacy and Ownership

Cryptographic techniques provide new methods for protecting data privacy. Homomorphic encryption enables model training without decrypting data, effectively protecting sensitive information in fields such as finance; zero-knowledge proofs allow for the verification of AI inference results without revealing specific data content. Projects like Grass incentivize users to contribute data in an effort to return data ownership to individuals and promote the development of data markets. However, decentralized data annotation still lags behind mature platforms like Scale AI in terms of quality and scale, and enterprises often face compliance challenges when sensitive data is directly placed on-chain—typically necessitating hybrid solutions involving TEE.

Open-Source Ecosystem and Censorship-Resistant AI

The combined strengths of Web3 and open-source models can help bypass the self-censorship often seen in traditional platforms. For example, projects like Venice.ai can support sensitive applications (e.g., NSFW content or political forecasting) that conventional platforms might shy away from. Nonetheless, open-source models are more vulnerable to adversarial attacks and generally lag behind polished commercial closed models in terms of performance and stability.

Comparative Summary

How AI Empowers Crypto

The Current State and Bottlenecks of AI Agents

AI Agents have been one of the hottest topics in the crypto world, sparking massive market interest. Initially, these agents boosted expectations for automated trading and enhanced DeFi strategies. However, following events such as the launch of Trump’s meme token, the market shifted from exuberant narratives to a harsh valuation correction, revealing several structural issues:

Mismatch between Technology and Valuation

Benchmark tests by the U.S. AI research institute Anthropic show that the average inference accuracy of most AI Agents in the crypto field is only 62%, far lower than the 82% observed in Web2 products (such as Claude 3). Additionally, 84% of AI Agent project teams have fewer than 5 members, yet their average valuation is as high as $43 million—approximately 3.7 times that of traditional SaaS startups. This phenomenon of high valuations supported by a small team creates an atmosphere of exuberance in bull markets, but when market sentiment reverses, token prices plummet rapidly, causing significant losses for investors.

Disconnect between Supply and Demand

From a user demand perspective, most current projects do not meet practical market needs. In automated asset management, about 72% of AI Agents only support basic limit order operations, lacking the capability for dynamic strategy adjustments; in cross-chain operations, an average of 5.7 signature confirmations are required per transaction—far from achieving a one-click operation driven by natural language; and in privacy protection, only 9% of projects have integrated zero-knowledge proof technology, leaving user behavior data at risk of centralized storage. These shortcomings on the supply side severely restrict the practicality and user experience of AI Agents.

Imbalance between Speculation and Innovation

Over the past year, among 327 newly issued AI-related tokens, 78% of projects have not released a verifiable testnet, and 62% of whitepapers have directly copied open-source frameworks, with developer activity averaging only 2.3 code commits per week. This indicates that many projects rely more on market hype than on genuine technological R&D and product implementation, resulting in an ecosystem filled with makeshift projects.

Additional challenges in the AI Agent ecosystem include:

Technical Issues:

Severe data silos (e.g., Bittensor subnet data sharing is inadequate) reduce overall training efficiency by 47%. In networks like HyperCycle, 32% of consumer GPUs face stability issues due to overheating, leading to a 19% inference failure rate. Some projects have even exploited validation weaknesses by fabricating transaction records to earn token incentives.Economic Distortions:

In certain leading projects, annual token inflation rates reach 38%—far outpacing revenue growth. Moreover, only 7.2% of on-chain transaction fees generated by AI Agents are funneled back to the protocol treasury; the remainder is captured by MEV bots, undermining value-capture mechanisms.User Experience Gaps:

Surveys indicate that around 68% of active users find AI Agent operations far more complex than centralized platforms. Only 12% understand the relationship between “self-custody” and TEE technology, and over 91% of on-chain interactions still revolve around simple token exchanges, lacking support for complex strategies.

On-Chain Models and Inference Services

Some projects are exploring the on-chain deployment of AI models to build decentralized AI model markets. For instance, Bittensor incentivizes developers to contribute models, while Ora Protocol records inference results on-chain for market forecasting or DAO governance. However, high on-chain storage and computing costs, slower response times, and the absence of unified interface standards have so far limited their commercial viability.

Product Breakthrough Directions and Future Pathways

To overcome these challenges, the industry is exploring three primary directions:

Reconstructing DeFai Infrastructure

Existing TEE solutions fall short of achieving full-process automation, and fluctuating gas fees make strategy execution unpredictable. Emerging approaches include semantic execution engines that convert natural language instructions into verifiable on-chain opcodes—paving the way for a “wallet as a browser” experience. For example, Fetch.ai’s “Intention Network” achieves 89% accuracy in parsing complex instructions, boosting development efficiency by up to 15 times. Additionally, the introduction of gas options contracts can help mitigate risks from gas fee volatility.Building a Value Accumulation Flywheel

Innovative economic models are critical. In a new model, user-contributed data can be tokenized as NFTs and monetized through differential privacy measures; developers employing federated learning and staking to optimize model training can earn rewards; and protocol revenues can be linked to token buybacks—with as much as 75% of profits used to repurchase tokens. Collaborative efforts from projects like Ocean Protocol, Bittensor, and Chainlink are already laying the groundwork for this approach.Deep Vertical Integration

In sectors such as finance and entertainment, AI Agents can be more deeply embedded into actual applications. In finance, integrating platforms like Nansen and Arkham, along with MEV protection mechanisms and automated compliance audits, has shown promising results—for instance, trials at Sygnum Bank indicate a 37% improvement in asset allocation efficiency. In entertainment, projects like Virtuals are exploring how AI Agents can manage NFT identities and participate in metaverse esports, with early tests showing a 2.3-fold increase in average daily user engagement compared to traditional GameFi projects.

Key Issues and Future Pathways in the Crypto+AI Track

Feasibility of Crypto-Native AI Models

When competing with general-purpose models, crypto projects lag behind traditional tech giants in computing power, data, and algorithm resources. However, by focusing on vertical domains, there remains potential to train specialized models using on-chain data (e.g., DeFi transaction records and user behavior). Sectors such as finance and gaming could benefit from tailored models, and fields with strict privacy requirements—like healthcare and finance—may find that using encrypted data for model training represents a significant entry point for crypto-native AI.

The Value Proposition of Crypto+AI

Crypto’s strengths lie in its permissionless economic systems and token-based incentive mechanisms. These features aggregate global, decentralized resources, lower innovation thresholds, and promote resource sharing. Furthermore, blockchain’s inherent transparency and immutability safeguard against censorship and ensure data ownership remains in the hands of users. However, success hinges on tightly coupling token economics with real-world demand, rather than relying solely on market speculation.

Trends for the Next 3–5 Years

Looking ahead, research and development are likely to focus on integrating zero-knowledge machine learning (ZKML) and fully homomorphic encryption (FHE) with AI models. Such advancements will enhance on-chain data verification and inference efficiency. AI governance DAOs are expected to expand, with AI Agents increasingly participating in on-chain voting and risk forecasting. Moreover, in gaming and social media platforms, on-chain copyright verification for AI-generated content may unlock new creative economies, while natural language interactions will further simplify asset management and transaction execution.

ICP’s Support and Exploration in the Crypto+AI Ecosystem

Product–Market Fit

ICP leverages its blockchain AI computing layer to demonstrate unique advantages in three key areas:

Trustworthy AI Infrastructure:

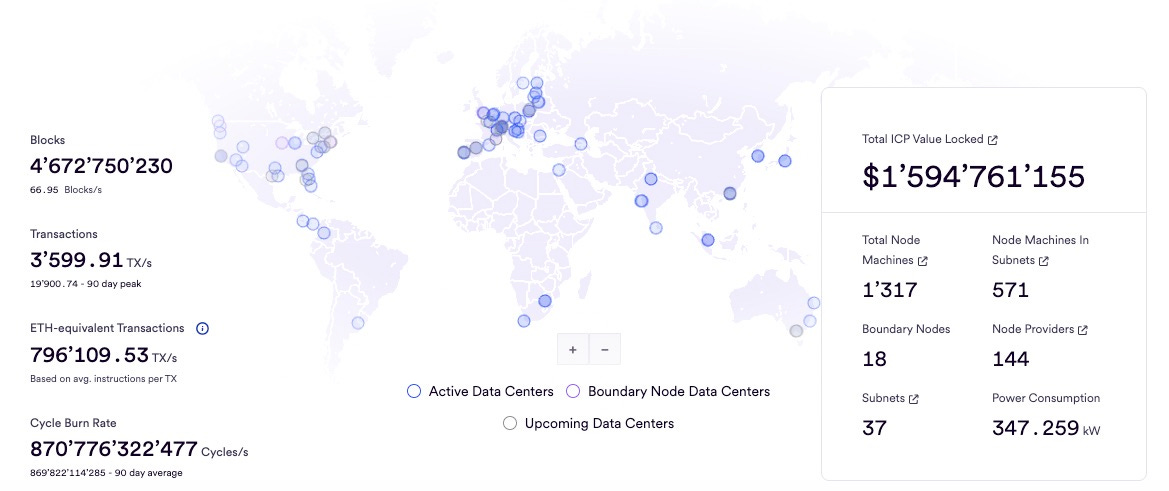

Utilizing chain key encryption and ZKML technology, ICP ensures that every step of the AI inference process is verifiable. Model parameters stored within smart contracts can be validated by all nodes, effectively eliminating “black box” issues. Additionally, reverse subnet technology aids in tracing the origins of training data, helping to resolve copyright disputes.Distributed Compute Market:

Through its NNS governance system, ICP aggregates resources from 144 independent data centers worldwide into virtual compute units. Dynamic pricing powered by the Cycles token makes these resources 58%–73% more cost-effective compared to AWS spot instances. Moreover, the platform supports federated learning, enabling collaborative model training across multiple parties.Data–Model Interaction Protocol:

ICP has built a dual-circulation system that transforms data into assets and models into tradable services. Data DAOs facilitate data rights management and revenue distribution, while Model NFTs enable the assetization of AI models, with compute certificates verifying the authenticity of compute consumption.

Technological and Application Practices

ICP’s full-stack decentralized architecture covers the entire process—from data ingestion and model training to inference verification. The use of homomorphic encryption and zero-knowledge proofs bolsters privacy and auditing capabilities. Recent tests have shown that ICP’s inference latency has dropped to 210 milliseconds, while model capacity has expanded from 100 million parameters in 2023 to 20 billion parameters in 2025. Developer activity on ICP is also significantly higher than industry averages. Real-world examples include:

BioNTech (Germany):

Leveraging ICP’s distributed drug discovery platform, vaccine R&D cycles have been reduced by 40%.Arpeggio (Art Platform):

Every generated image is recorded on-chain, ensuring style authenticity and automating royalty distribution.Sygnum Bank (Switzerland):

With an on-chain risk control model deployed on ICP, loan approval times have been cut from 72 hours to just 9 minutes, and default prediction accuracy has reached 91.3%.

Summary

The convergence of crypto and AI illustrates the potential to overcome centralized limitations through decentralization and enhanced privacy. While the decentralized compute market and AI Agent ecosystem face significant technical, economic, and user-demand challenges, breakthroughs in vertical domains and token incentive models that are closely linked to real-world applications offer promising paths forward. ICP’s real-world applications demonstrate that a fully on-chain, trustworthy infrastructure can support the burgeoning Crypto+AI ecosystem. As technology and economic models continue to evolve, this field is poised to achieve more efficient, transparent, and practical applications.

Notes

The data points referenced (e.g., “144 global data centers,” “AI Agent market cap drop”) are primarily sourced from the DFINITY whitepaper, Electric Capital, MIT, AI Ethics Lab, IDC, Crunchbase, and related research. Readers are advised to consult independent third-party reports for the most current and accurate data.

The views expressed in this article are synthesized from publicly available information from 2024 to 2025 and do not constitute investment advice.

References

CoinGecko: AI Agent market cap data (February 2025)

Electric Capital 2024 Report: ICP ecosystem AI DApp and cross-chain interaction data

DFINITY Whitepaper: ICP technical architecture and case studies

MIT AI Ethics Lab: GPT-5 bias analysis (2025)

Crunchbase: AI Agent project valuation and team size statistics

Binance Research: 2024–2025 trends in AI and Crypto integration

Archetype VC: Analysis on AI agent interactions and the decentralized compute market

Foresight News: Evaluation framework for AI x Crypto projects

IEEE Xplore: Research on privacy-enhancing technologies and AI security

BBC News: Analysis of Trump-era policies and their impact on Crypto regulation (2025)